Index funds have become a popular investment choice for new and seasoned investors. They offer a simple, cost-effective way to invest in the stock market. But why are they often considered a smart option? Let’s explore the key advantages of investing in these funds and how they can benefit your financial future.

Low Fees for Better Returns

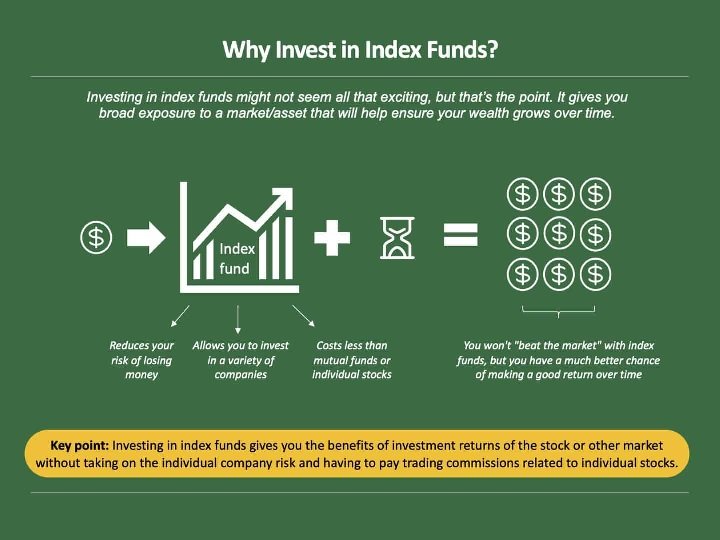

One of the main attractions why you should invest in mutual funds like these is their low fees. Unlike actively managed funds, index funds don’t require frequent buying and selling of stocks. This reduces operational costs, allowing people to keep more of their returns. Over time, these savings can add up, significantly impacting your overall portfolio. Isn’t it great to know that your money can grow without being eaten up by high fees?

Diversification Reduces Risk

Another key benefit is their built-in diversification. When investing in an index fund, you automatically buy into a wide range of companies. This diversification helps effectively spread risk across different sectors and industries. If one stock performs poorly, the impact on your asset is minimised because other stocks can balance the loss. Diversification is essential for long-term success, as it reduces the risk of heavy losses.

Consistent Long-Term Growth

Index funds are known for delivering consistent returns over time. While the stock market can be volatile in the short term, it tends to grow steadily in the long term. Index funds, which track major market indices, benefit from this upward trend. People can enjoy long-term growth by staying patient and not reacting to daily market fluctuations. Have you ever wondered how steady growth can impact your future financial goals?

Lower Risk Compared to Stock Picking

Investing in individual stocks can be quite risky, especially for those who don’t have a lot of experience. Index funds lower that risk by exposing a broad range of companies. Instead of relying on the performance of one or two stocks, index funds distribute your acquisition across an entire index. This reduces the chances of losing much of your money due to poor stock performance. Lower risk makes index funds a safer option for conservative people.

Tax Efficiency Helps Maximize Gains

Tax efficiency is another advantage of index funds. Because they are passively managed, index funds don’t generate as many taxable events as actively managed funds. Fewer trades mean fewer capital gains taxes, which can help maximize your returns. Over the long term, tax efficiency can make a noticeable difference in how much you earn from your acquisitions. Keeping more of what you earn is always a win, isn’t it?

Ideal for Long-Term Investors

Index funds are particularly well-suited for long-term investors. The stock market has historically grown, and index funds mirror this trend. By staying invested for the long haul, people can ride out market downturns and benefit from the overall upward trajectory of the market. This long-term approach is crucial for building wealth and achieving financial independence.

How to Invest

After seeing all these benefits, you may wonder how to invest in index funds. Well, the answer is simple! First, decide which index you want to track, such as the S&P 500 or a broader market index. Then, open an investment account with a brokerage firm or a robo-advisor. Many online platforms offer index funds with low minimum investments, making them accessible to most people. After choosing your fund, simply purchase shares and let the fund do the rest.

When you invest in mutual funds like these, you enjoy various benefits, from low fees and diversification to consistent growth and tax efficiency. Whether new to investing or a seasoned pro, index funds offer a simple, low-risk way to build wealth over time. By understanding the key advantages of these funds, investors can make informed decisions and enjoy steady growth with minimal effort.